Real Estate Is (Still) a Strong Investment — Perspective on Low Rates

Updated March 6, 2020. “The Fed made the rare move to lower the federal funds rate by a half-point to a range of 1% to 1.25% in between its regularly scheduled meetings. The central bank noted that the move was in response to the “evolving risks” the COVID-19 coronavirus outbreak poses to the economy… Mortgage rates have plummeted since the beginning of the year to the lowest average since 2016 as a result of market movements in response to the coronavirus. While the Federal Reserve adjusts short-term interest rates, mortgage rates fluctuate based on long-term bond rates.” [source: marketwatch.com]

What does a 0.25% rate decrease mean in terms of dollars? That for every $1,000,000 a buyer borrows it will equate to a savings of around $2,500 annually ($208/month) in terms of payment.

From a macro point of view, as interest rates decrease, then we are likely to see more investment into the U.S. economy as money becomes cheaper to borrow, such as mortgages to purchase homes. Buyers can stretch their budget as the same monthly payment can support a higher purchase price, or for the same purchase price, Buyers can save money each month due to interest savings.

On the flip side, as interest rates decrease, savers may experience a drop in interest payments as savings, money market, and bank CD rates decline. This may be a good time to purchase rental properties to provide a more steady income stream in the future, even if rates continue to decline. Furthermore, in strong rental markets like Los Angeles, landlords can count on strong tenant demand in years to come to continue to fill vacancies as they arise.

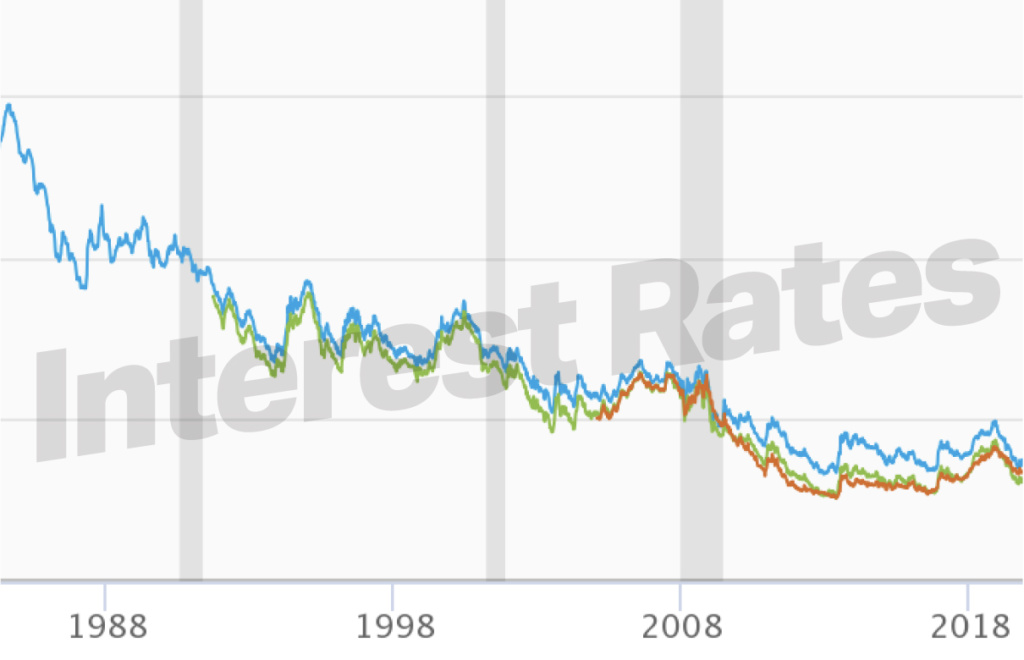

In our office, we refer to the Morningstar Andex Chart, the Historical Interest Rate chart from Freddie Mac and MLS data to educate our agents and clients.

“Starting early and investing consistently over long periods of time history suggests that markets can be resilient—especially for those with the patience to stay invested.”

[source: bnymellon.com]

[Data source: Freddie Mac]